What is it all about?

Expensify does "expense reports that don't suck!" Take pics of your receipts & Expensify will "read" them, create an expense and do your expense report for you! Lose the paper receipts, get Expensify!

Video & screenshots

screenshots

Who is it for?

Key Features

• SmartScan captures receipt information and automatically creates the expense for you • Import personal, corporate, and commercial cards • Receipt images are automatically associated to credit card transactions • Capture mileage, time, and other reimbursable/billable expenses • Auto categorized expenses • Lost the receipt? No problem! IRS Guaranteed eReceipts are created for all imported expenses under $75 • Custom data exchange allows integration with any accounting, payroll, or CRM solution

Benefits

Simplified expense reporting your employees will love. Streamline the way your employees report expenses, the way expenses are approved, and the way you export that information to your accounting package.

Pricing

Description

Sign up now — it's completely free, no credit card needed.

Integrates With

Product Analysis

Expensify is a simplified expense reporting system for your organization. It was designed to simplify the way your employees report their expenses and the way you approve them. It also simplifies the way you export expenses the the company accounting package.

Dealing with expenses is a headache for every organization. It is a tedious chore for administrators, and employees hate the hassles. Expensify simplifies and automates every aspect of the process. As a result, expenses are tracked better, and employees are happier.

But don’t think that Expensify is limited or crippled in any way. From its support for 160+ currencies and international tax regimes, to its free mobile apps, Expensify has you covered. Since expense information needs to be used in various parts of your organization, Expensify integrates with virtually any accounting, payroll, CRM or ERP solution.

SmartScan is a particularly useful feature of this service. This is patented OCR (Optical Character Recognition) software that matches credit card transactions with receipts. It eliminates manual data entry, making the whole process faster and more accurate.

Also, Expensify is a cloud-based product. This means you don’t have to deal with the hassles of purchasing, installing, and maintaining their software on your servers. Because your people connect to Expensify’s servers when they log in to the system, everyone will always be using the latest version of the product.

To help you figure out if Expensify is the right expense reporting system for your organization, we’re going to take a detailed look at the main features of this SaaS product. We’ll start with Expenses.

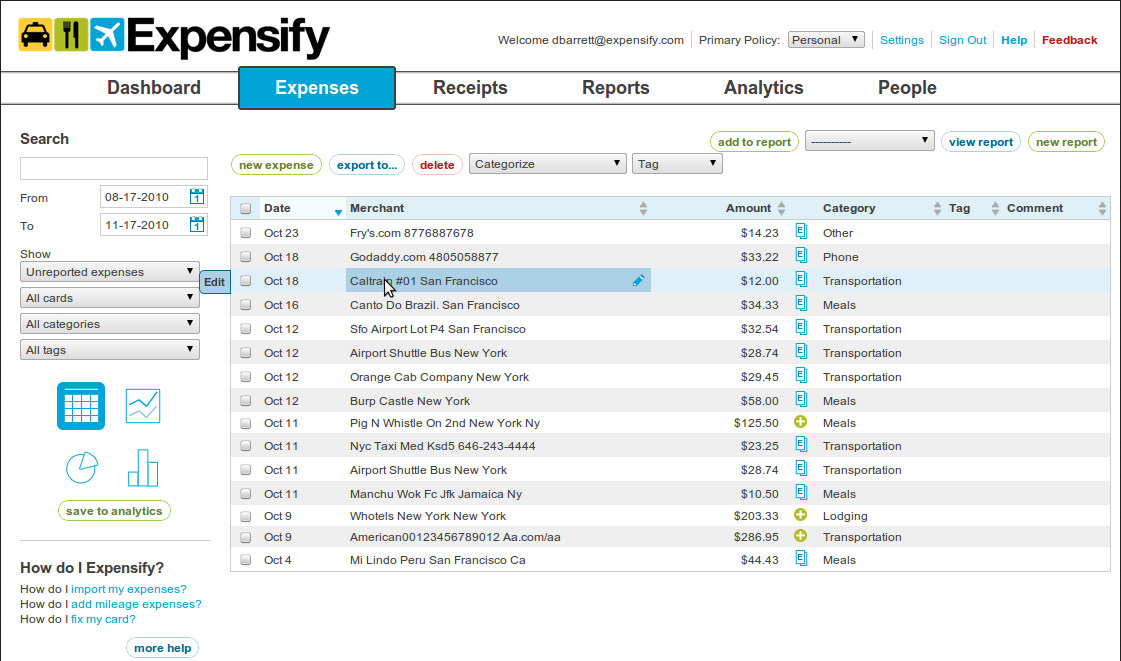

Expenses

Expensify handles both cash expenses and credit or debit card transactions. It can connect directly to bank accounts to import the expense information for all the major cards you and your employees are likely to use. Once expenses are in the system, Expensify can auto-categorize them. It uses your organization’s particular accounting policies to do this, making life easier for your accountants.

Do you have an international business? No worries. Expensify supports over 160 currencies. It also knows how to handle international taxes such as VAT, GST, and HST.

If you are a consultant, or otherwise incur expenses for your clients, you will need to rebill expenses those expenses. Expensify allows you to identify those expenses in several different reports, then automatically generate a custom invoice and send it to the customer.

Next, let’s talk about those annoying receipts.

Receipts

Keeping track of paper receipts is one of the biggest annoyances of traditional expense reporting systems. Expensify allows you to completely eliminate this headache. With the camera in your smartphone and the Expensify mobile app, you can scan and upload paper receipts right at the spot you receive them.

Once you shoot a receipt, SmartScan takes over. It uses OCR technology to extract information from the receipt, then matches the receipt to the expense. This can eliminate most or all manual entry of receipt information, and eliminate the need to keep track of all those pieces of paper.

If you have online receipts you don’t have to print them then photograph them to get them into the system. Instead, you can email them to Expensify and let the service take care of processing them for you. If this doesn’t meet your needs, you can install a Google Chrome extension to do the job, or import the receipt through integrations with EverNote, DropBox, GeniusScan, and other services.

As you have seen, Expensify makes like easier for anyone who has to track and report their expenses. But what about the administrators who need to deal with all those expense reports?

Administration

Expensify simplifies the lives of your administrators too. It allows them to process reports individually. But it also handles bulk actions so they can do things like mark hundreds of expense reports as “reimbursed” at once.

With Expensify handling all the organization’s card transactions, your people can administer and reconcile all transactions in one place. One advantage of all the expense reports being handled in Expensify is that it can apply automated processes to eliminate the problem of duplicate expenses.

The service also helps you with reimbursing expenses. It gives you the ability to issue reimbursements through the following means, all without an additional charge:

- ACH Direct Deposit

- PayPal

- Standard Payroll

- Bitcoin

We’ve now seen how Expensify simplifies and automates getting expense information from your people. And how it simplifies life for your administrators when they are handling all those expense reports. Next we will look at how Expensify ensures that your organization complies with all policies and reporting requirements.

Compliance

To ensure compliance you can specify rules that Expensify will enforce. You can create rules based on specific expense types and characteristics. Examples include:

- Maximum expense amount allowed

- Whether receipts are required

- Whether comments are required

Once this is in place, the approval of expense reports is governed by this automated, rule-based work flow. Strict compliance is enforced so you know your organization’s rules are always followed. In addition, the service can generate history reports that include digital signatures. This provides a full audit trail should it ever be necessary.

Now that we understand what Expensify can do once it has expense reports to process, it is time to go back to the beginning of the expense entry process. The mobile apps that your people use to capture expense information are vitally important. Let’s examine what they can do.

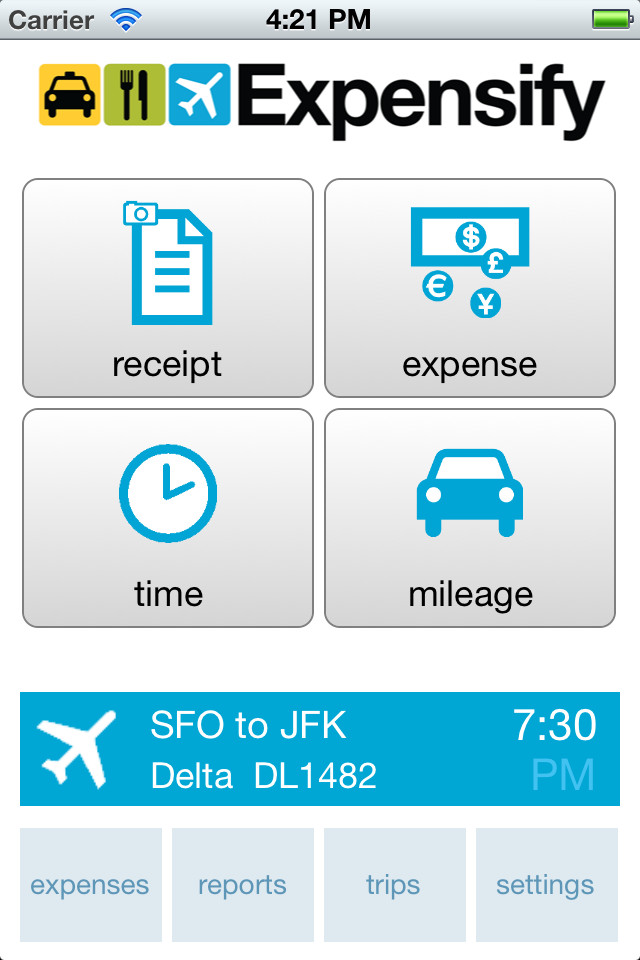

Mobile Apps

It used to be that you could recognize a businessperson on a trip by the piles of receipts they were carrying around with them. It was frustrating, and I am sure I’m not the only person who couldn’t account for all their expenses after a trip because they couldn’t find a receipt (or two or three). Expensify’s mobile apps can eliminate this problem by allowing you to capture your expense information immediately.

The free Android, iOS, Blackberry, and Windows Phone apps allow you to snap pictures of your receipts as soon as they are generated. The apps also allow you to track billable hours easily. If you log mileage, you can enter that information manually, or simply record odometer readings. You can even let the app track mileage for you using your device’s GPS. You can then integrate all this information into your expense report, which you can also create and submit right on your mobile device.

You might be wondering what happens of you have no data service while entering expenses. You don’t need to worry. The apps work offline. They store everything for you until the device is back online, then automatically synchronize with the Expensify servers.

While Expensify is powerful and flexible, it only deals with creating and processing expense reports. For other functions, the service offers a set of integrations.

Integrations

Expensify integrates with a range of other solutions and services. These integrations fall into three categories: Custom Date Exchange, Expensify Private API, and Automated Account Provisioning.

Custom Data Exchange allows Expensify to share data with accounting, payroll, CRM, and ERP solutions. Examples of well-known services that work with Expensify include SAP, QuickBooks, ADP, and Microsoft Dynamics.

The Expensify Private API allows you to schedule data pulls from the service into business systems like Microsoft Dynamics.

With Automated Account Provisioning, you can have Expensify automatically create or delete an expense account for an employee based on their profile in HR.

SmartReports

Do you use Expensify to track your expenses even though you still have to submit those expenses in an Excel spreadsheet? If so, SmartReports may be just what you need. You can upload a copy of your spreadsheet to Expensify. They will analyze it and when you submit an expense report, SmartReports will fill out the company spreadsheet for you, with receipts included.

The Blog

One of the nice things about Expensify is that the service continues to evolve and add new capabilities. For example, in March 2016, they announced a partnership with Uber to automatically record the expenses of your business travel in Uber vehicles. Perhaps the best way to keep up with all the changes is to visit the Expensify blog.

The blog posts cover pretty much anything to do with the company. To help you find what you are looking for you can sort the posts by category, or do a standard keyword search.

Pricing

Expensify offers three tiers of pricing: Team, Corporate, and Enterprise. The Team tier includes the basics of the service, and costs $5 per month per active user. According to Expensify, “An active user is anyone that has edited (created, submitted, approved, exported, etc) expense data on a company policy in a given month.” The Corporate tier includes additional features and is $9 per month per active user. The Enterprise tier includes all the features. The price for this tier is negotiated directly with Expensify, and assumes a minimum of 1,000 active users per month.

To see what is included in each pricing tier, visit the pricing page.

Conclusion

Expensify is a service designed to take the pain out of dealing with expense reports. With its mobile apps, SmartScan feature, automation, and compatibility with other business solutions, many businesses have found it to be useful. Assuming it looks useful to you too, your next step should be a free demo. To sign up for a free demo, click this link.

If you like what you see in the demo, or just want to jump in with both feet first, Expensify offers a free trial of their service. You don’t even need to enter a credit card. All you need to do is enter an email address and click the big green “Sign Up For Free” button at the top of this page.

Read more about Expensify on DiscoverCloud or our knowledge base.

Top DiscoverCloud Experts

Interested in becoming a DiscoverCloud Expert? Learn more

Compare Products

Select up to three two products to compare by clicking on the compare icon () of each product.

{{compareToolModel.Error}}

{{CommentsModel.TotalCount}} Comments

Your Comment